The new tax law adds commercial roofs to section 179 property and doubles the deduction to 1 million.

New roof depreciation 2019.

28 2017 and placed in service before jan.

31 2017 and the amounts will be indexed for inflation starting in 2019.

These new limits are effective for properties placed in service in taxable years beginning after dec.

Bonus depreciation is being offered at 100 in 2018 and can be applied to equipment expenses that go beyond the 2 5 million spending cap.

Refer to the section 179 website to view the qualifying equipment.

In addition the tax cuts and jobs act expanded the definition of qualified real property eligible for section 179 to include improvements to nonresidential roofs.

1 2018 remains at.

There are several different types of equipment that are eligible for the deduction including new roofing.

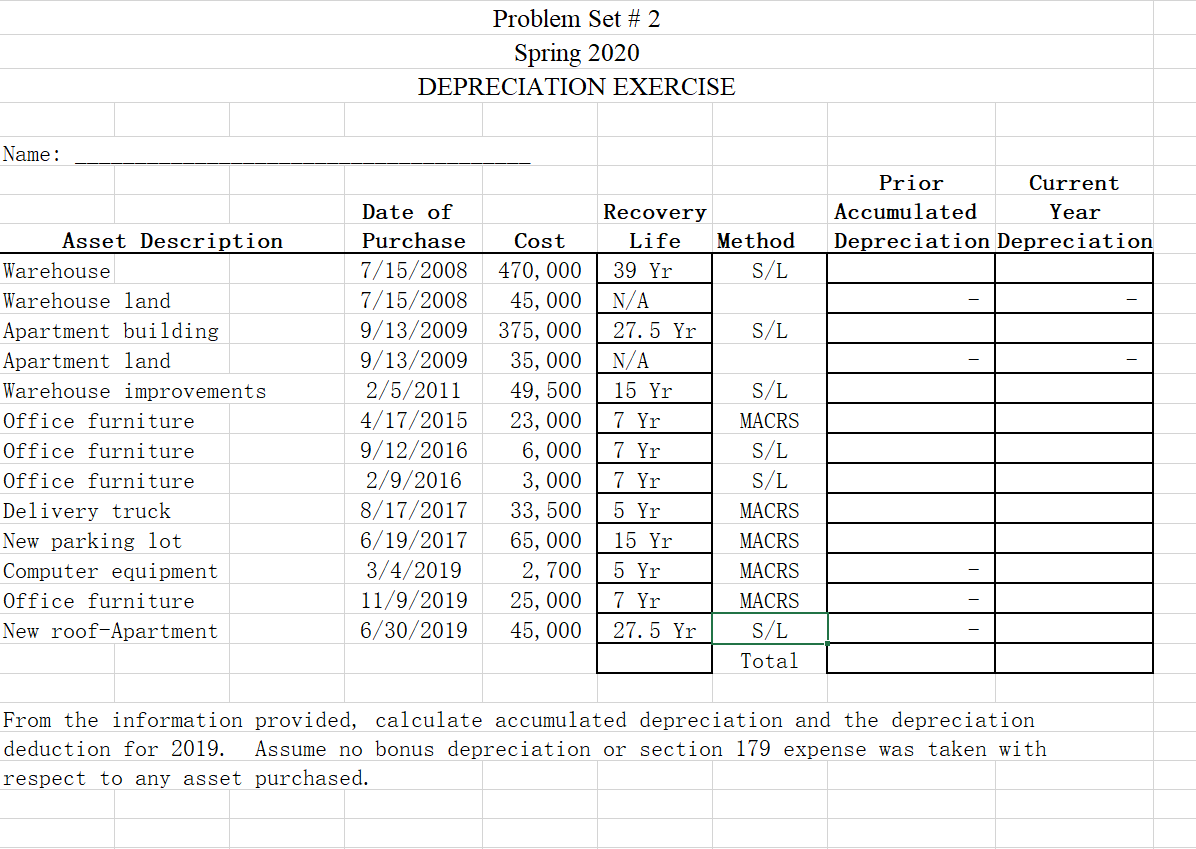

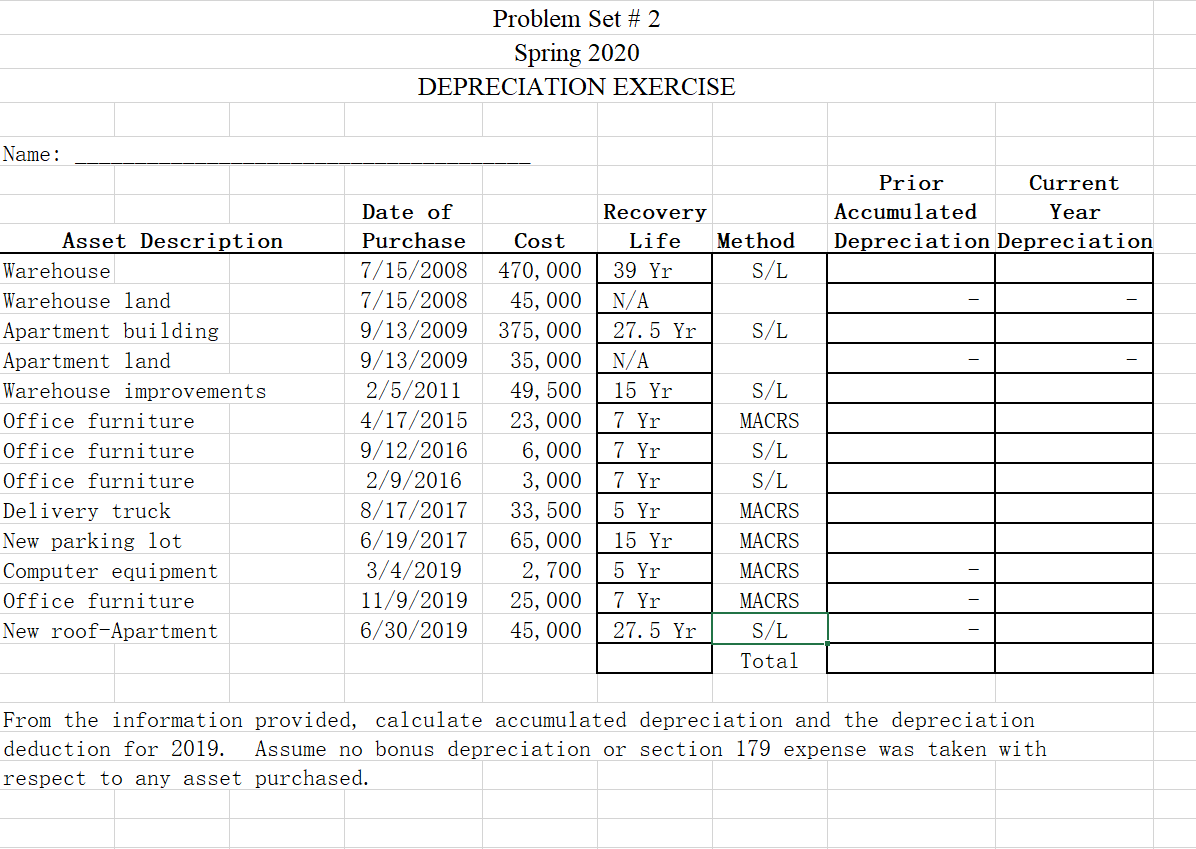

If you have a commercial roof tax planning for 2019 as it relates to your budget process is different than it was in 2018.

Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

27 2017 and before jan.

The new law also reduces the commercial roof depreciation schedule from 39 years to 25 years which is much more realistic.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

The bonus depreciation percentage for qualified property that a taxpayer acquired before sept.